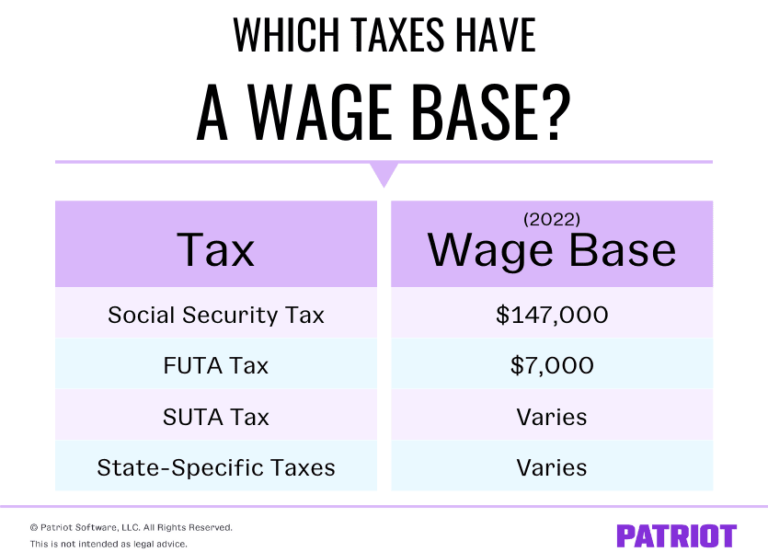

Medicare Wage Base 2025. We call this annual limit the contribution and benefit base. The social security wage base has increased from $160,200 to $168,600 for 2025,.

For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare). There is no maximum wage limit for.

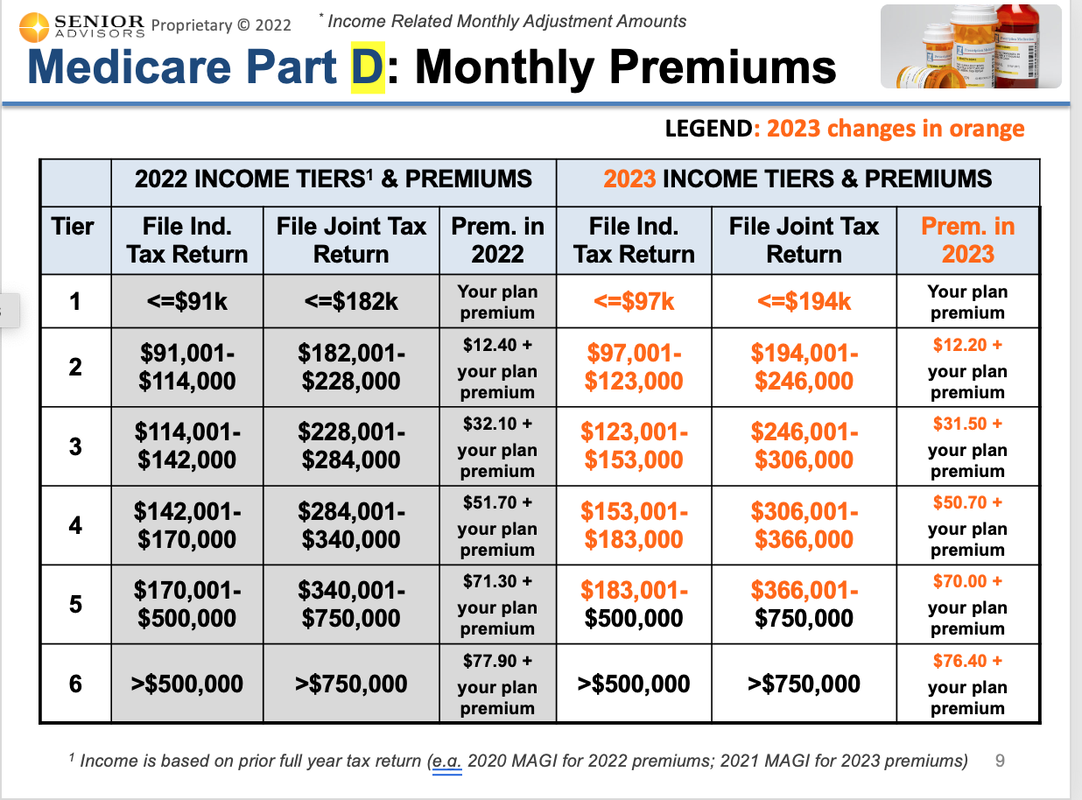

Irmaa is an extra fee that you pay on top of your medicare part b and d rates if you earn above a certain threshold.

The Basics of Medicare and Medicaid, The maximum social security wages, or social security wage base for 2025 is $168,600. Maximum social security tax for employees.

Medicare Open Enrollment There’s Still Time! Group Plans, Inc., Individual taxable earnings of up to $168,600 annually will be subject to social security tax in 2025, the social security administration (ssa). For 2025, an employer must.

Medicare Blog Moorestown, Cranford NJ, For 2025, an employer must. There is no maximum wage limit for.

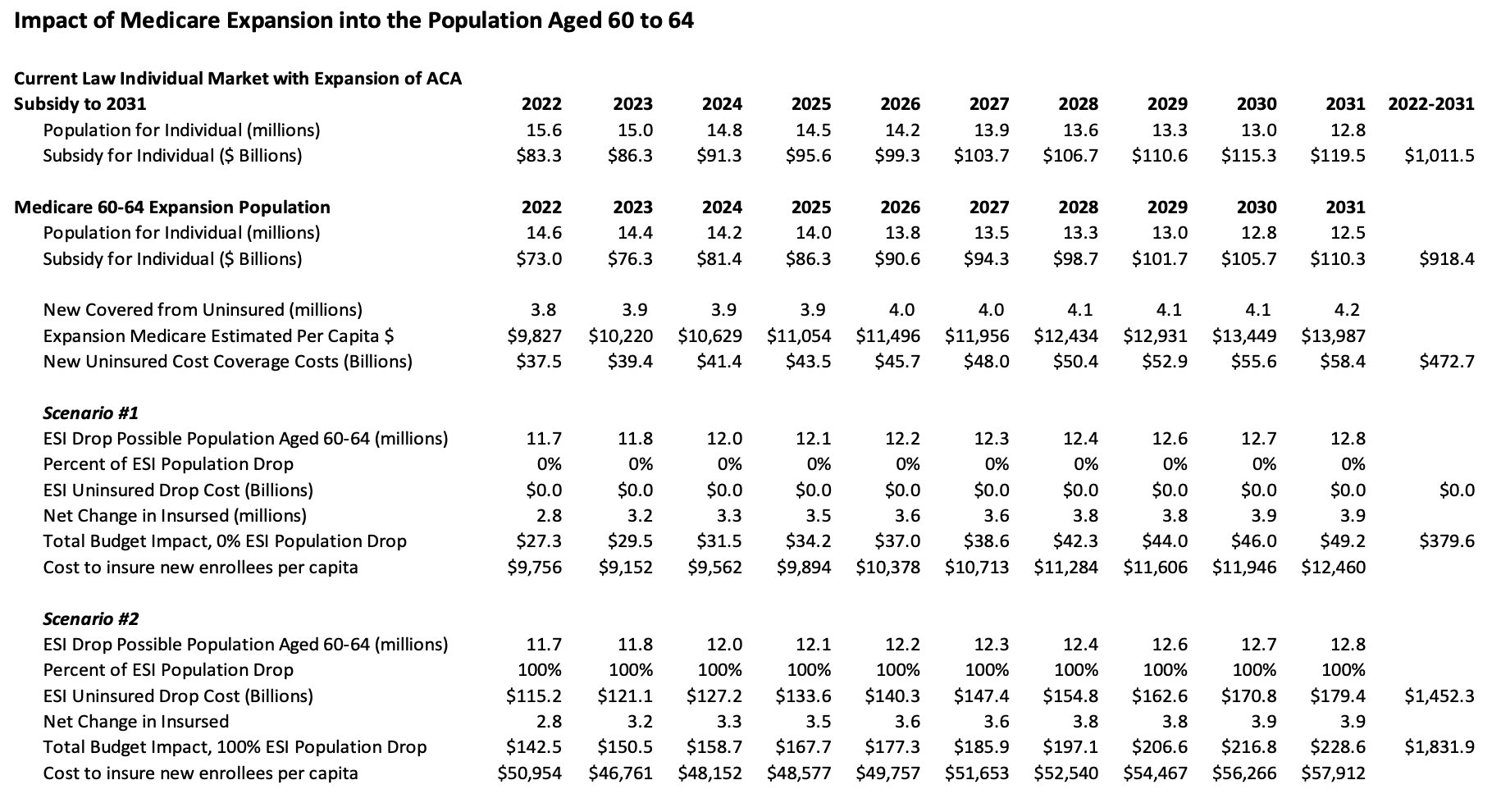

Lowering the Medicare Age to 60 Cost and Coverage AAF, The 2025 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2025. Social security and medicare tax rates remain unchanged for 2025.

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png)

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, The social security administration has announced the social security tax wage base for 2025 will be $168,600, an increase of $8,400. The social security wage base has increased from $160,200 to $168,600 for 2025,.

Do Medicare and FEHB Work Together?, For 2025, an employee will pay: Irmaa is an extra fee that you pay on top of your medicare part b and d rates if you earn above a certain threshold.

Medicare Wage Index Webdale Healthcare, The 2025 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2025. On october 12, 2025, the centers for medicare & medicaid services (cms) released the 2025 premiums, deductibles, and coinsurance amounts for the medicare part.

2025 Medicare Part B Premiums Just Released…, For 2025, an employee will pay: The social security administration has announced the social security tax wage base for 2025 will be $168,600, an increase of $8,400.

Cost Of Medicare Part B In 2025 Q2023H, The internal revenue service has announced an increase in the social security wage base to $168,600, up from $160,000. The 2025 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2025.

What Is a Wage Base? Taxes With Wage Bases & More, Dec 18, 2025 | tami arnold. On october 12, 2025, the centers for medicare & medicaid services (cms) released the 2025 premiums, deductibles, and coinsurance amounts for the medicare part.

Hyundai Incentives August 2025. 4.99% apr for 60 months on select hyundai sonata hybrid models. Lease a 24 tucson sel…

Jerry Yan Latest News 2025. He stars opposite xu ruo han in “the forbidden flower,” which. Jerry yan (calvin lu)…

2025 Highlander Ebrochure. It will slot between the highlander and sequoia suvs and offer two hybrid engines. Visit the official…