Maximum Depreciation For Vehicles 2025. 946 for official guidance around 179 depreciation rules. The total section 179 deduction and depreciation on a passenger automobile (including trucks or vans) used for your business and put into service in 2025 is either $19,200.

This figure is the maximum value you can use to calculate depreciation on a car, provided the following conditions are met: For cars in 2025, the exact percentage depreciation that can be expected will depend on these factors, among others.

Vehicle Depreciation 2025 Lillian Wallace, Autos with unloaded gross vehicle weight (gvw) of more than 6,000 lbs.

2025 Bonus Depreciation Rate Today Michael Bailey, Maximum deduction limits for vehicles certain vehicles are not subject to the section 280f depreciation limits:

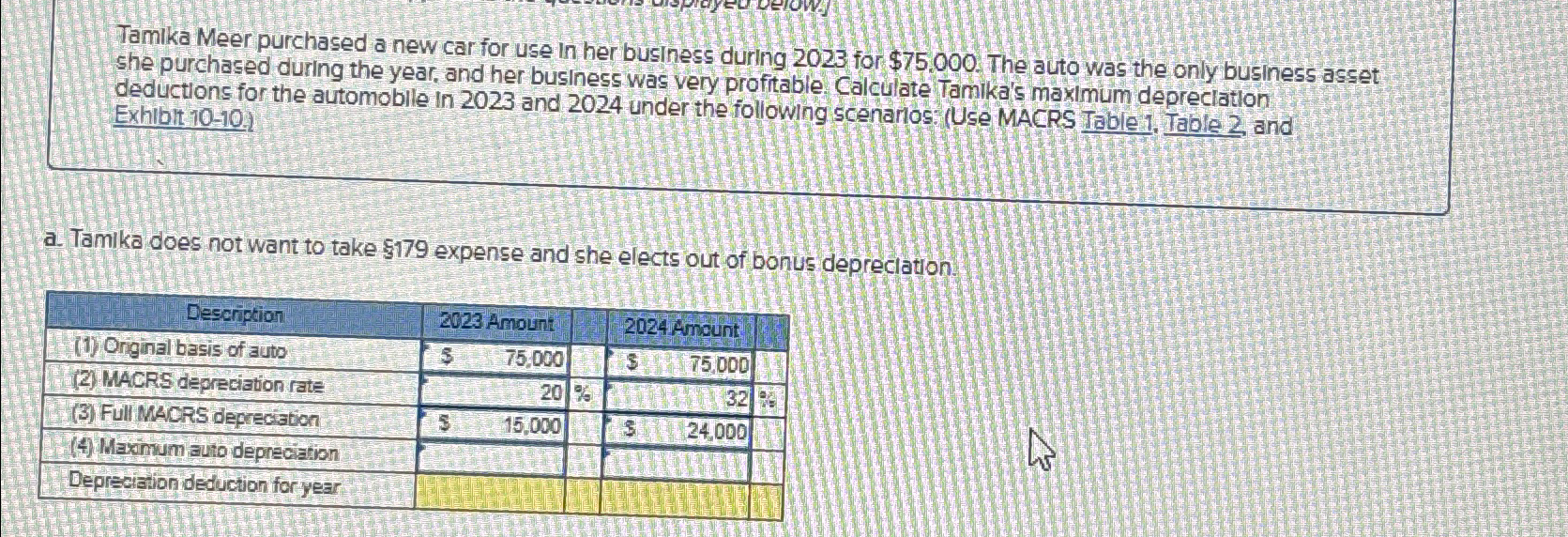

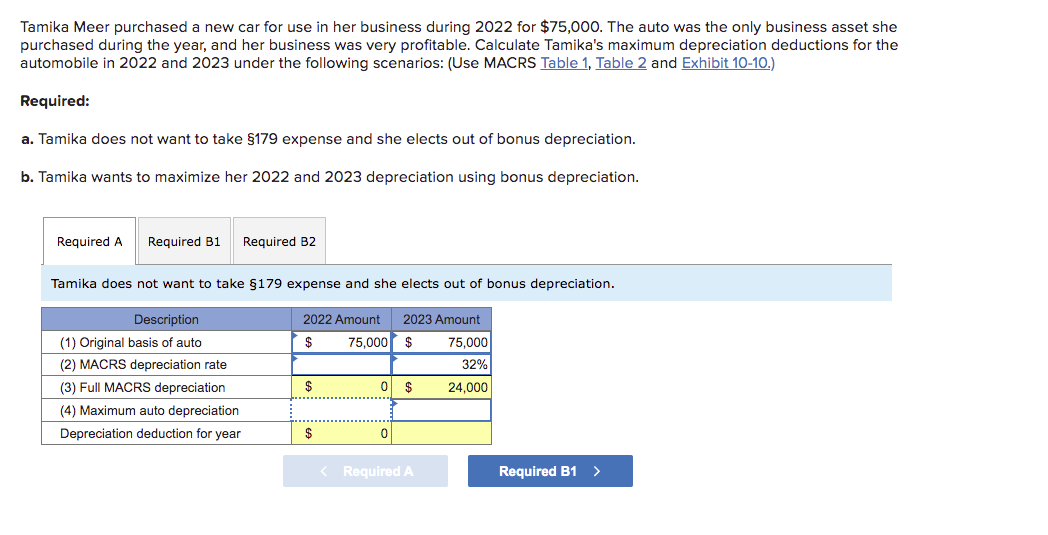

Solved Tamika Meer purchased a new car for use in her, By comparing the depreciation rates of 2025 models to those of previous years, we can gauge the potential value loss of 2025 vehicles over time.

Tamika Meer purchased a new car for use in her, The total section 179 deduction and depreciation on a passenger automobile (including trucks or vans) used for your business and put into service in 2025 is either $19,200.

Bonus Depreciation Rules For 2025 Lucas Lawrence, 80% for property placed in service after december 31, 2025, and.

Bonus Depreciation For 2025 Tommi Isabelle, 80% for property placed in service after december 31, 2025, and.

2025 Auto Depreciation Limits Alisun Agretha, The maximum section 179 expense deduction is $1,250,000, and this expense is reduced by the amount of section 179 property is placed in service during the tax year that.

Bonus Depreciation For 2025 Tommi Isabelle, 80% for property placed in service after december 31, 2025, and.